Legally Compliant Asset-Backed Tokens!

Get Started with our advance asset tokenization platform

Get Started with our advance asset tokenization platform

Make your real estate investments accessible, digital and global through a legally compliant token structure. Tokenization of commercial real estate ensures the illiquid assets are digitized, thereby, making the investments as world’s largest and most secure of asset classes.

The fractional ownership of existing art pieces helps artists and galleries with viable businesses by making paintings into commodities and adding a monetary value. This opens up the art world into uncharted territory where the decision-makers are the investors or the token holders.

Stablecoins are hailed as the Holy-grail of cryptocurrency market. Beyond the stable value for the trade and investments, stablecoins also allow exchanges to get their hands on the much needed liquidity.

Tokenization helps investors keep track of their Investment Funds without the need for an intermediary. The VC fund tokens comply with financial regulations and allows investors to buy and sell tokens in the trading platform or over the counter(OTC).

There are many assets which cannot be readily converted to cash. These could be current, fixed or even intangible assets. These can be tokenized without any loss of value with an increased trading volume , thereby, yielding profits for the investors and the project.

Mining repository is a highly illiquid asset which is an ideal industry for tokenization. Gold backed cryptocurrency, silver backed cryptocurrency or a renewable energy cryptocurrency are the future of commodity and futures trading helping highly illiquid assets become liquid.

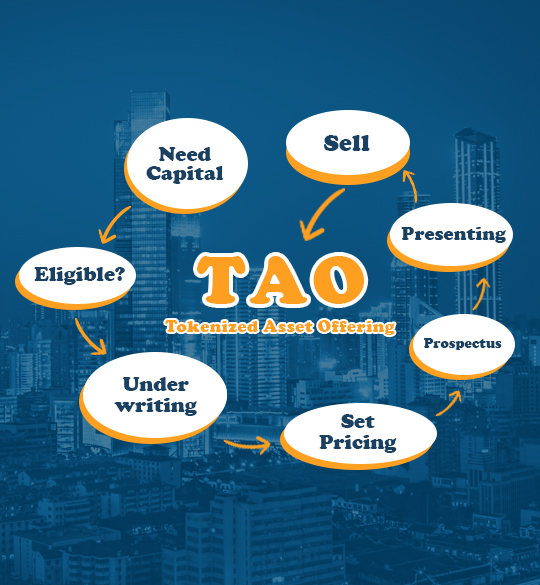

Finding the Illiquid asset to tokenize such as commercial estate. We at Goodsecurities carry out our due diligence for tokenization.

Our auditing and financial consultants will advise on the jurisdiction checks with regards to the asset titles such as zero debts and any other parameters specified by owner.

A Special Purpose Vehicle or Entity(SPV/SPE) is formed especially when tokenizing commercial real estate which would own the complete assets under the SPV/SPE.

The technology behind the Tokenization of the Asset is the strength of Goodsecurities. We believe ERC-20 is not an ideal solution for TAO due to the gas prices, congestion of networks and changes in protocols. Goodsecurities will build customized blockchains with inbuilt smart contracts on top of the Ethereum or in Hyperledger or Stellar.

The valuation of the assets are scrutinized by auditing firm , post-which a value per token is suggested and the issuance company such as yours can issue a token at that price.

Once the token is developed with regulations embedded into the smart contract, a dashboard will be provided for investor management for the issuer and fund management for the investors. The dashboards include KYC/AML, Accredited Investor verification and voting rights in-built for investors and project owners.

The tokens are offered through a Tokenized Asset Offering(TAO) for investors to purchase a legally compliant token under the framework of the legal requirements. As the smart contract ensures the automation of regulatory requirements, there are no requirements of third party intermediaries such as transfer agents.

Once the TAO is completed, the token are to be listed on the Security Token Exchanges for investors to trade on the secondary market. These can also be traded through Over The Counter(OTC) where the accredited investors can trade directly with the token holders.

| Legally Compliant Token Architecture | Pakage 1 | Pakage 2 | Pakage 3 |

|---|---|---|---|

| Technology | |||

| Custom Ethereum Token |  |

|

|

| Own Blockchain |  |

|

|

| Hyperledger Burrow |  |

|

|

| Integrated Voting Rights Platform |  |

|

|

| Token Wallet as per Regulatory Protocol |  |

|

|

| Investor Managment Dashboard |  |

|

|

| Automated KYC/AML Integration |  |

|

|

| Automated Accredited Investor Verification |  |

|

|

| Stake Holder Registry |  |

|

|

| Integrated Dividend Issuance Platform |  |

|

|

| KYC/AML records Registry |  |

|

|

| Accredited Investors Registry |  |

|

|

| Market Capitalization Details |  |

|

|

| Funds Raised & Investment Details |  |

|

|

| Integrated Help Desk on Dashboard |  |

|

|

| Audit Reports & Checklists |  |

|

|

| Portfolio Management for Investors |  |

|

|

| Announcements within Dashboard |  |

|

|

| Uploading Legal Documents & Disclaimers |  |

|

|

| Investor Prospectus |  |

|

|

| Whitepaper (Owner's Manual) |  |

|

|

| Customized Website |  |

|

|

| Legal & Regulations | |||

| Preliminary Checks |  |

|

|

| Development of Documents |  |

|

|

| Customized Website |  |

|

|

| Token Purchase Agreement |  |

|

|

| Development of the Token’s Legal Structure |  |

|

|

| Disclaimers for the website and marketing materials |  |

|

|

| Token Crowdsale Terms |  |

|

|

| Private Placement Agreement with Private Investors |  |

|

|

| Legal Opinion on the Sale of Tokens |  |

|

|

| SAFT Agreement |  |

|

|

| Token Purchase Agreement |  |

|

|

| Company Valuation Audit |  |

|

|

| Incorporation - Pre STO | |||

| Establishment of the holding company in Malta |  |

|

|

| Establishment of the holding company in USA |  |

|

|

| Establishment of the Maltese trading company |  |

|

|

| Establishment of the USA trading company |  |

|

|

| Company Valuation Audit |  |

|

|

| Registration of the Operation Company |  |

|

|

| Legal Agreements between Holding and Main Operational Company |

|

|

|

| Local Directors if Required |  |

|

|

| Registered Office |  |

|

|

| Tax Compliance |  |

|

|

| Application of Licenses |  |

|

|

| During STO | |||

| Liaise with MFSA & MDIA for Compliance |  |

|

|

| Liaise with SEC for Compliance |  |

|

|

| Post STO | |||

| Accounting & Book Keeping |  |

|

|

Make your real estate investments accessible, digital and global through a legally compliant token structure. Tokenization of commercial real estate ensures the illiquid assets are digitized, thereby, making the investments as world’s largest and most secure of asset classes.

Issuance companies face problems during secondary trading when different countries are involved. Our tokens can be traded across borders with the idea that the tokens issued are securities and must comply with securities laws. The token sales and secondary trading are developed with conditionality on the smart contract.

Blockchain ensures all the transactions including the conditional are visible to the financial regulators. The benefits of a transparent ecosystem will help the cryptocurrency market under the purview of the government regulation. The process of transfer agents are being automated the entrepreneurs can raise funds in a simpler and a cost effective way.

At Goodsecurities, we develop a technology which allows the issuance companies to reissue tokens to the investors if the investor loses their wallet keys subject to terms and conditions. The wallet must compatible to the legal requirements and investor must have the right to reclaim his lost tokens.

A proprietary voting platform built on blockchain enhances security, transparency and scalability which is stored on a distributed ledger. An ecosystem of governance is created for your companies security token structure to meet your needs. This reduces the overhead in the voting process and makes the governance of your organization easier and increase trust among your investors.

In the regulated TAO, the basic requirements are KYC/AML verification reduces the risk through reputation scoring which helps issuance companies identify high-risk individuals . This helps you prove your investor’s identity,risk-based authentication and preventing identity fraud. In addition, you can also reduce money laundering activities.

KYC/AML automation help in efficient onboarding of the investors in a quicker time frame.. In addition, you can stay ahead of the regulations through a flexible interface where you can respond to new developments with ease.

In a simple, reliable and confidential interface companies can verify their investors. When the client signs up for our TAO, a simple questionnaire, few certification requirements along with the uploading of supporting documents are sent to their mail.

We take the necessary steps in a legal way to verify the accredited investors. It is important to note that the background verification must be done via professionally licensed attorneys with ethical codes maintaining confidentiality.

A customized end-to-end tokenized assets issuance platform for issuers and their specific target industry. Issuance companies can tokenize their assets such as commercial or residential real-estate.

As an issuance company, you can provide Tokenization as a Service and the tokens generated has the following features :

Automated Compliance with Blockchain & Smart Contracts.

Globalized KYC/AML Verification

Multi-Ledger Security Token Development(EOS, Hyperledger or Stellar)

Automated Policy and Regulations with Smart Contracts

Non-Fungible Tokens for every Security Token Issuer

Automated reporting to Regulatory Authorities

Tokens issued have an interoperability layer for exchanges across the world